Rule one investing calculator

This calculator tells you if youre getting a good deal when you buy their stock. For example if youre 30 you should keep.

Dollar Cost Averaging Don T Get Caught In A Trap Rule 1 Investing

One response to Rent Calculator Alice Carroll says.

. This type of split comes with a tactic to limit that risk. It applies more to house flippers who need to buy a house for 70 of its ARV after repaired value minus repair costs to account for their holding buying and selling costs and still make a profit. The level of additional contributions you can make continues to increase until the end of the tenth anniversary after which all withdrawals from the bond are tax-free.

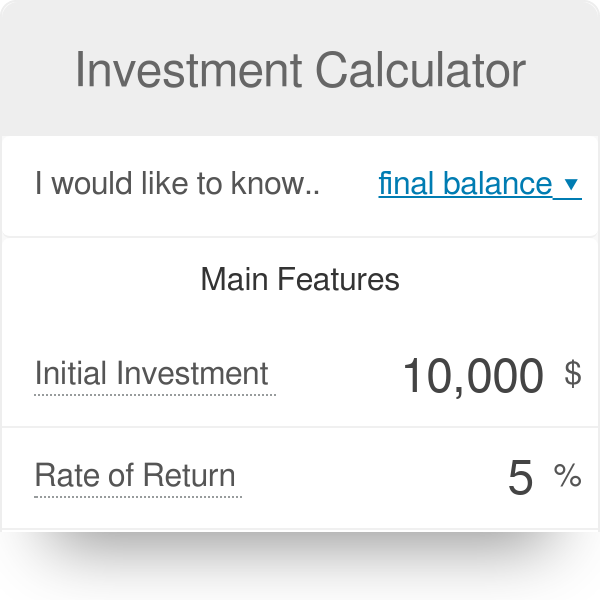

How to Use These Investment Calculators. For example if you invest 10000 in year one then using the 125 rule 12500 125 10000 may be invested in year 2 and so on. Benjamin Grahams wrote the book The Intelligent Investor first published in 1949.

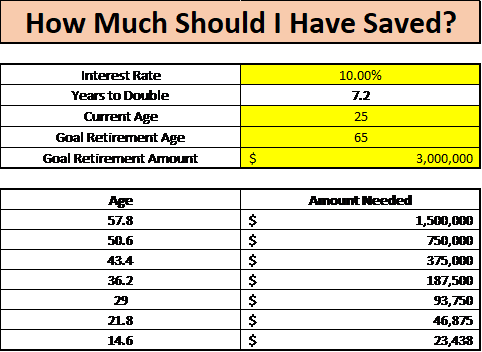

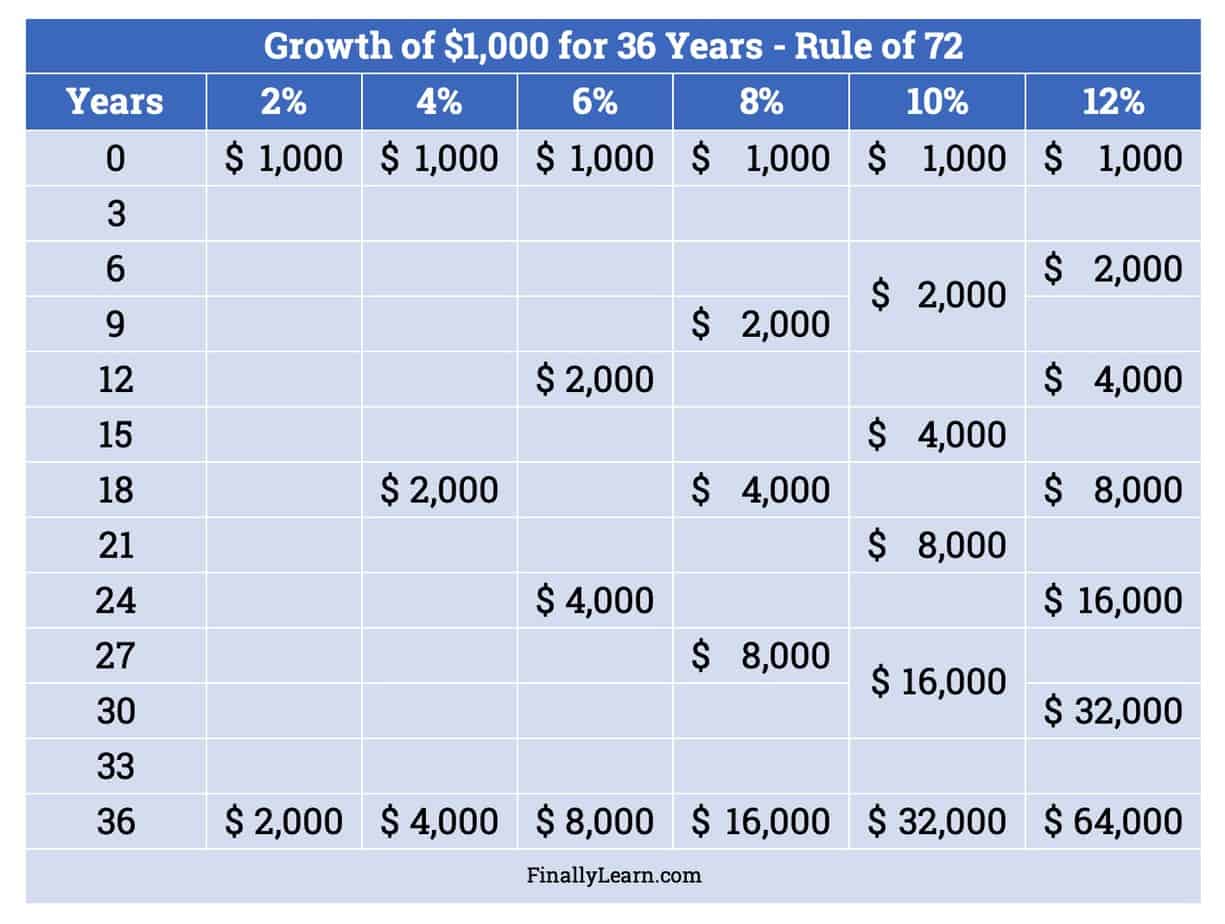

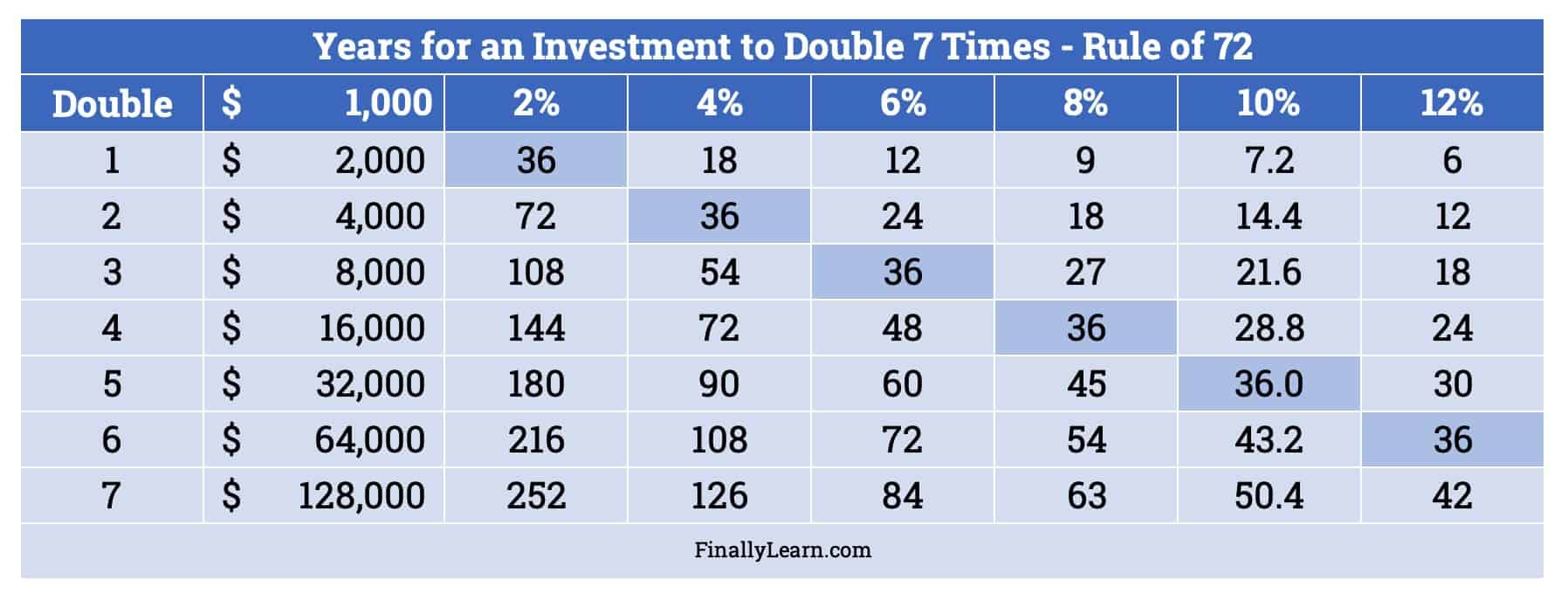

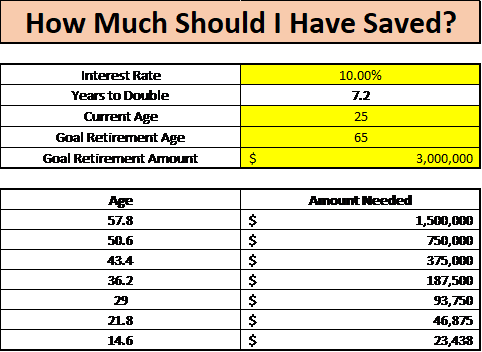

The Rule of 72 provides an estimate of how long it will take for an investment to double in value. In a larger sense investing can also be about. The Rule 1 Sales Growth Rate calculator helps you determine this rate of growth.

The Intrinsic Value formula is also know as the Benjamin Graham formula. If you dont have a scientific calculator on hand you can usually use the one on your smartphone for advanced functions. If you have acquired restricted securities.

As a general rule you should spend no more than 30 of your monthly income on rent. The old rule of thumb used to be that you should subtract your age from 100 - and thats the percentage of your portfolio that you should keep in stocks. Use our rent budget calculator to find out how much you should really spend.

Budgets should be about more than just paying your bills on timethe right budget can help you determine how much you should be spending and on what. The last point is one more real estate investing rule of thumb we havent talked about commonly called the 70 rule. A 1550 stock rule takes on more risk than a rule that is based on your age.

An unanticipated flood causes 250000. The 503020 rule also referred to as the 502030 rule is one method of budgeting that can help you keep your spending in alignment with your savings goals. The rule states that you should spend up to 50 of your after-tax income on needs.

Sales Growth Rate is one of the Big 5 Numbers required to determine whether a company may be a Rule 1 wonderful business. Investing is the process of buying assets that increase in value over time and provide returns in the form of income payments or capital gains. The Famous Intrinsic Value calculation written by Benjamin Graham.

You can adjust the proportion 5 one way or the other. But you may need to use a different formula for precise timing. The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a substantially identical one within 30 days.

While board feet is the accepted standard in. The Sales Growth Rate of a business is the the rate at which it is growing its sales year over year. Rule 1 investing is based around some very specific calculations that.

How the 80 Rule Works for Home Insurance For example James owns a house with a replacement cost of 500000 and his insurance coverage totals 395000. Under federal securities laws all offers and sales of securities must be registered with the SEC or qualify for some exemption from the registration requirements. However the basic calculation can give you a good.

The 50-20-30 or 50-30-20 budget rule is an intuitive and simple plan to help people reach their financial goals. One of the most difficult aspects of investing is knowing exactly how to value a business and figuring out if a stock is at a good price to buy. This may be higher or lower depending on the other expenses you have such as any debt payments you need to make.

It can also estimate the yield of standing trees using the Wiant and Castaneda adaptations of the Doyle Scribner and International 14 rule. Selling restricted or control securities in the marketplace can be a complicated process. Value Investors have been using The Intrinsic Value calculation since Benjamin.

This is very true if you are in your 70s Building your portfolio to a 5050 split then leaving it to grow assumes a higher risk by default. The Intelligent Investor is a famous book among Value Investors. On this page is a board foot log rule calculator which will estimate the board foot yield of a log using the Doyle or Scribner log scale rules or the International log rule with a 14 or 18 kerf.

Federal securities laws may deem certain securities as restricted or control securities.

Rule Of 72 In Investing Formula And Calculator Finally Learn

Historical Investment Calculator Financial Calculators Com

Ultimate Investment Calculator Income Calculator

Rule Of 72 In Investing Formula And Calculator Finally Learn

Ultimate Investment Calculator Income Calculator

Present Value Calculator Pv Useful For Legal Settlements

Rental Property Calculator Most Accurate Forecast

Investment Calculator Learn Investment Formula

Rule 1 Investing Spreadsheet Download Spreadsheet Spreadsheet Template Investing

Rental Property Calculator Most Accurate Forecast

A Convenient Rule Of 72 Calculator To Help Investors Plan For Retirement

Rule 1 Investing Spreadsheet Download Excel Templates Stock Analysis Report Template

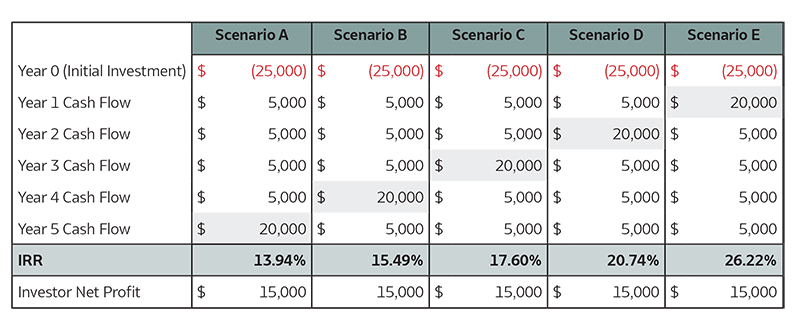

Real Estate Calculator Use Irr To Find Profits Arborcrowd

Rule 1 Investing Spreadsheet Download Fundamental Analysis Stock Analysis Report Template

![]()

Evaluate A Company Using Financial Metrics Rule 1 Investing

Rental Property Cash On Cash Return Calculator Invest Four More

Rule 1 Investing Spreadsheet Download Spreadsheet Spreadsheet Template Investing